What is the capital stack? And why is it important for your property development?

by Marshall Condon | June 18, 2020

Risk and return levels in the Australian capital stack

There are two key considerations with any investment: risk and return. In terms of risk, investors always need to consider what the outcome will be if things don’t go according to plan. For example, the Covid-19 coronavirus was unanticipated, but there’s no denying it has had a yet-to-be-calculated impact on the property development sector.

The financing of real estate developments is relatively complex, with funding coming from a variety of different sources during the lifespan of a project. Investors will expect a return that compensates them for their level of risk exposure.

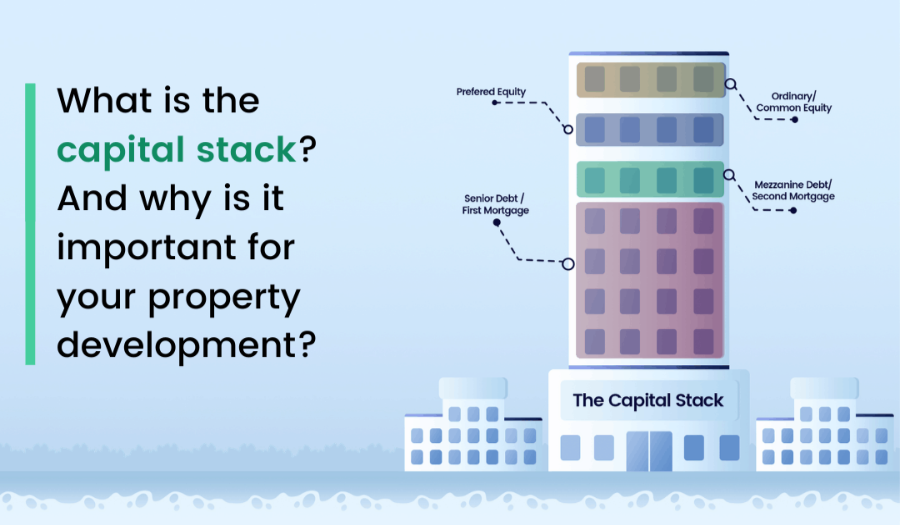

Together, these financing sources are often called the capital stack. It’s referred to as a ‘stack’, as this describes how each source is layered upon the other. Each has its own collateral, return expectations and – importantly – repayment priority.

The Australian commercial real estate sector has four main funding sources: senior debt, mezzanine debt, preferred equity and ordinary (common) equity. Each of these funding levels in the capital stack has its own characteristics, including risk level, repayment prioritisation and return expectations.

The table below is a good summary of the factors for each funding source in the Australian property development capital stack:

| Senior debt / First Mortgage | Mezzanine debt / Second Mortgage | Preferred equity | Ordinary / Common equity | |

| Risk level | Low | Medium | Medium - High | High |

| Repayment prioritisation | 1st | 2nd | 3rd | 4th |

| Secured against | First Registered Mortgage | Second Registered Mortgage | Deed of Priority* | Shareholder agreement |

| Return expectations | 4%-8% | 12%-20% | 8%-10% + Kicker | 10%+ |

| Loan to Value Ratio (LVR) | 50%-65% | 65%-75% | N/A | N/A |

*sometimes

Senior Debt: Senior debt is borrowed money that a company must repay first if it goes out of business.

First Registered Mortgage: A first mortgage is a primary lien on a property. As a primary loan that pays for the property, the loan has priority over all other liens or claims on a property in the event of default.

Second Registered Mortgage: A second mortgage is a loan taken out on a property on which you already have a mortgage. The loan or mortgage that is registered second is called the second mortgage and is subordinate to the first mortgage.

Deed of Priority: Deed of Priority assigns the rights which each creditor will have pertaining to recovering the debts which the specific debtor in question owes them all should that debtor default.

The 4 tiers of the capital stack

1. Senior Debt

Senior debt usually takes the form of a first mortgage, funded by a bank and secured by the property itself. The term ‘senior’ means the bank is first in repayment prioritisation if the deal goes bad, so they can sell the property to recoup the money it loaned.

Before offering financing, a bank will do due diligence to calculate the value of the secured property. If they need to sell, they can be confident the amount recovered is sufficient to cover the loan balance, at the very least.

With senior debt, the funder expects the loan to be repaid through periodic payments, including interest, over the specified period of time. As part of their analysis, the bank estimates the income to be generated by the property development project and that it is sufficient to make the required loan repayments.

As senior debt is first in line for repayment, and because it is secured by the property and any improvements, it poses the least risk of all the funding sources in the capital stack. That is why it requires the lowest level of return; typically in the 4%-8% range.

2. Mezzanine Debt

Mezzanine debt, often referred to as a second mortgage, is a loan taken out on a property that already has a registered first mortgage (senior debt). It allows a developer to access additional equity in a property over and above what the first mortgage provides.

Like a first mortgage, the investor expects the loan to be repaid through periodic payments, including interest, over the loan term. However, there are two main differences between mezzanine debt and senior debt.

Firstly, mezzanine debt is second in line to be repaid, meaning that the senior debt holder (usually a bank) must be repaid in full before any funds are available to the mezzanine debt holder. Also, mezzanine debt is usually not secured by tangible assets (like the property); it is instead secured by an interest in the borrowing entity. A well-planned mezzanine facility produces an increased return for the developer and allows them to preserve equity.

As mezzanine debt carries a higher risk than senior debt, the funder demands a higher return on their capital, typically in the 12% – 20% range.

The mezzanine debt sector is considered the fastest-growing, most dynamic market in the Australian finance industry. With the range of mezzanine debt available as diverse as the rates and fees charged, the very latest information is essential in securing the best deal.

With second mortgage loans through to sophisticated, senior-subordinated structured finance transactions available, knowledge of the mezzanine and structured debt sector is required through a funder like Wefund.

3. Preferred Equity

Preferred equity financing works in a similar way to mezzanine debt because it’s used to fill gaps in funding or increase the leverage on a commercial property development. It sits in third position in the capital stack, so it’s less senior than all forms of debt (senior and mezzanine) but more senior than common equity.

However, while mezzanine debt is usually secured by equity in the borrowing entity or management company, preferred equity is secured by the ability to force the sale of a property, if needed.

In return for these associated risks, the investor is compensated with a steady return in the form of regular payments, as well as an opportunity to participate in the upside of the project – for example, equity – should it meet certain performance goals. These goals are clearly outlined in the investment contract and typically establish a threshold, above which an equity ‘kicker’ allows the preferred equity holder to participate in additional profits.

Returns for a preferred equity investment are typically in the 8% – 10% range, plus kicker, and may go higher with equity participation.

The preferred equity market is very dynamic and it relies on fast analysis and quick decision-making, so as to give potential investors the best advice possible. This is where Wefund’s expertise, technology platform and daily involvement in funding markets can help investors take advantage of the wide arbitrage that exists in this sector.

4. Ordinary / Common Equity

Common equity is the riskiest component of the capital stack but potentially the most profitable. This is because it only provides a pro-rata return in the upside of the development if it is profitable, once the other positions in the capital stack have been repaid. This return could be in the form of income (dividends), or as a capital gain if the shares are sold.

Often, as part of the agreement to finance a property development project, a lender will require that the borrower invests their own money to ensure they have a vested interest in its success. These funds represent the common equity portion of the capital stack and are last in line to be repaid should the project fail. Common equity investments are usually unsecured.

In return for being last in line in repayment prioritization, the common equity investor is compensated with virtually unlimited upside. Because the return potential is great and the funds are their own, a common equity investor has a significant vested interest in the success of the project.

How can Wefund help?

If you want to take advantage of the current opportunities in the commercial property market – particularly in Melbourne and Sydney – check out our streamlined registration and application process.

We’ll do an initial evaluation of your financing needs then connect you to our pool of more than 60 top-tier lenders across the capital stack for non-bank property development finance at competitive terms and rates.

For more information on the funding opportunities Wefund offers, take a look below.

Mezzanine Finance

Construction Loans

Bridging Finance

Refinance / Equity Release

What’s next?

Click here to start your loan application for funding to expand your property development portfolio: https://platform.wefund.com.au/register

RECEIVE UPDATES

Have a loan scenario?

Find out how wefund can help you with fast, transparent non-bank property and development finance. Provide your scenario details below and we’ll get back to you right away.

© 2026. All rights reserved.